Intermediate Accounting------Chapter 7

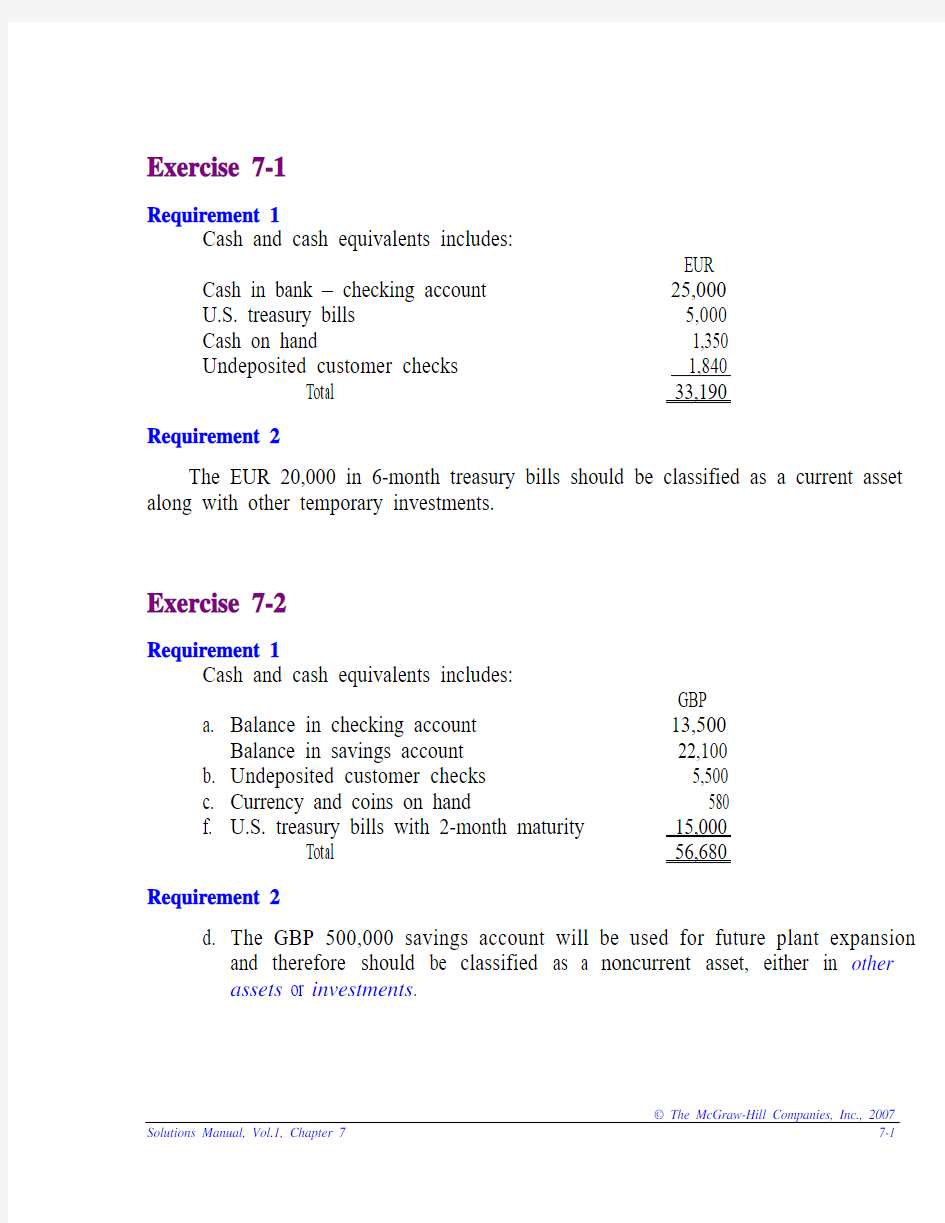

Exercise 7-1

Requirement 1

Cash and cash equivalents includes:

EUR

Cash in bank – checking account 25,000

U.S. treasury bills 5,000

Cash on hand 1,350

Undeposited customer checks 1,840

Total 33,190

Requirement 2

The EUR 20,000 in 6-month treasury bills should be classified as a current asset along with other temporary investments.

Exercise 7-2

Requirement 1

Cash and cash equivalents includes:

GBP

a. Balance in checking account 13,500

Balance in savings account 22,100

b. Undeposited customer checks 5,500

c. Currency and coins on hand 580

f. U.S. treasury bills with 2-month maturity 15,000

Total 56,680

Requirement 2

d. The GBP 500,000 savings account will be used for future plant expansion

and therefore should be classified as a noncurrent asset, either in other

assets or investments.

? The McGraw-Hill Companies, Inc., 2007 Solutions Manual, Vol.1, Chapter 7 7-1

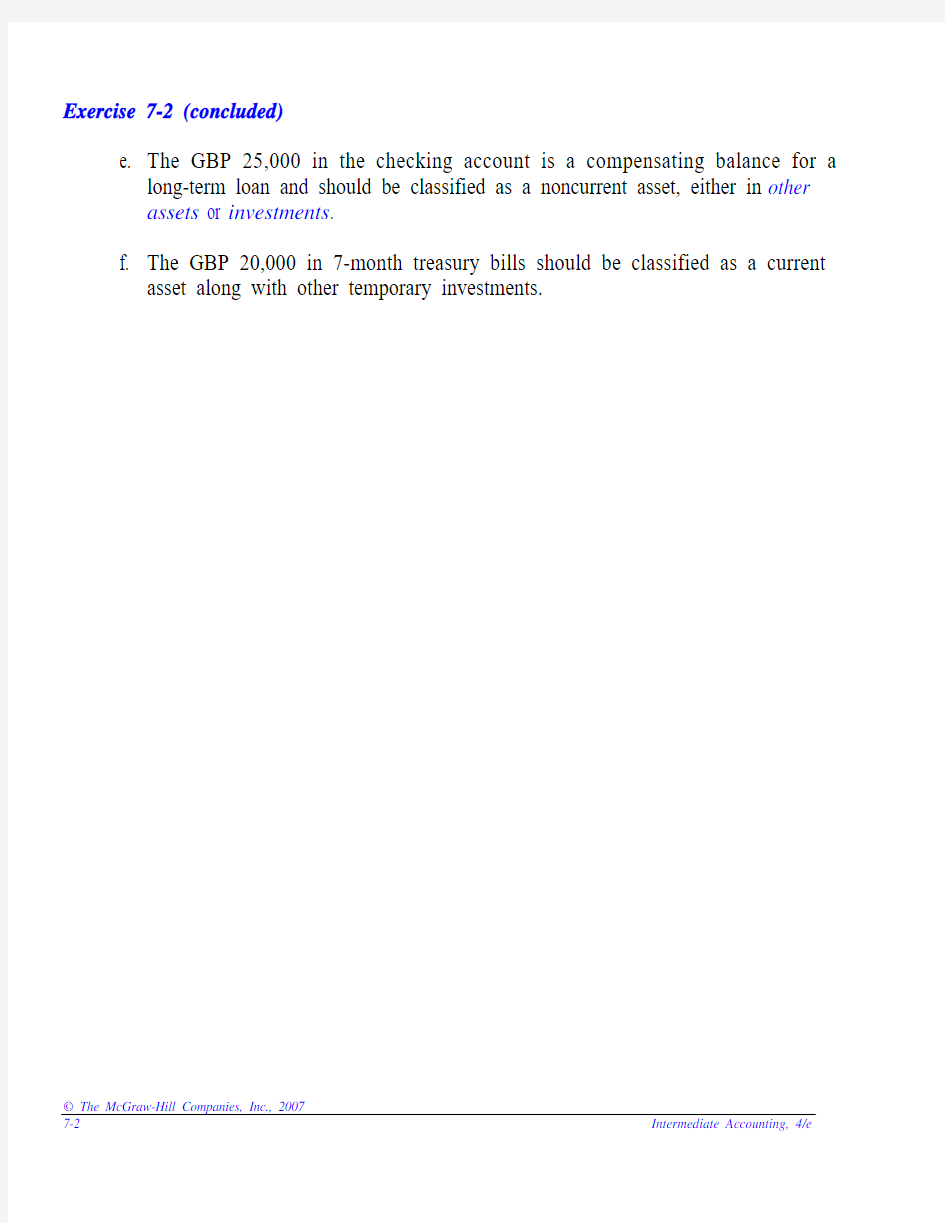

Exercise 7-2 (concluded)

e. The GBP 25,000 in the checking account is a compensating balance for a

long-term loan and should be classified as a noncurrent asset, either in other

assets or investments.

f. The GBP 20,000 in 7-month treasury bills should be classified as a current

asset along with other temporary investments.

? The McGraw-Hill Companies, Inc., 2007

7-2 Intermediate Accounting, 4/e

Exercise 7-3

Requirement 1

Sales price = 1,000 units x 55 = 55,000

Requirement 2

? The McGraw-Hill Companies, Inc., 2007 Solutions Manual, Vol.1, Chapter 7 7-3

Exercise 7-4

Requirement 1

Requirement 2

? The McGraw-Hill Companies, Inc., 2007

7-4 Intermediate Accounting, 4/e

Exercise 7-5

Requirement 1

Sales price = 100 units x 500 = 50,000 x 70% = 35,000

Requirement 2

? The McGraw-Hill Companies, Inc., 2007 Solutions Manual, Vol.1, Chapter 7 7-5

Exercise 7-5 (concluded)

Requirement 3

Requirement 1:

Requirement 2:

? The McGraw-Hill Companies, Inc., 2007

7-6 Intermediate Accounting, 4/e

Exercise 7-6

Requirement 1

To record the write-off of receivables.

To record the collection of a receivable previously written off.

Allowance for uncollectible accounts: EUR

Balance, beginning of year 32,000

Deduct: Receivables written off (20,000)

Add: Collection of receivable previously written off 1,200

Balance, before adjusting entry for 2006 bad debts 13,200

Required allowance: 10% x 625,000 (62,500)

Bad debt expense 49,300

To record bad debt expense for the year.

Requirement 2

Current assets: EUR

Accounts receivable, net of 62,500 in allowance

for uncollectible accounts 562,500

? The McGraw-Hill Companies, Inc., 2007 Solutions Manual, Vol.1, Chapter 7 7-7

Exercise 7-7

Requirement 1

67,500 (1.5% x 4,500,000)

Requirement 2

Allowance for uncollectible accounts

MYR Balance, beginning of year 45,000

Add: Bad debt expense for 2006 (1.5% x 4,500,000) 67,500

Less: End-of-year balance (40,000)

Accounts receivable written off 72,500 Requirement 3

MYR 72,500 — the amount of accounts receivable written off.

Exercise 7-8

($ in millions)

Allowance for uncollectible accounts:

Balance, beginning of year $242

Add: Bad debt expense 44

Less: End of year balance (166)

Write-offs during the year $120*

Accounts receivable analysis:

Balance, beginning of year ($5,196 + 242)$ 5,438

Add: Credit sales 36,835

Less:Write-offs* (120)

Less: Balance end of year ($5,890 + 166) (6,056)

Cash collections $36,097

? The McGraw-Hill Companies, Inc., 2007

7-8 Intermediate Accounting, 4/e

Exercise 7-9

Using the direct write-off method, bad debt expense is equal to actual write-offs. Collections of previously written-off receivables are recorded as revenue.

Allowance for uncollectible accounts:

MXN Balance, beginning of year 17,500

Deduct: Receivables written off (17,100)

Add: Collection of receivables previously written off 2,200

Less: End of year balance (22,000)

Bad debt expense for the year 2006 19,400

? The McGraw-Hill Companies, Inc., 2007 Solutions Manual, Vol.1, Chapter 7 7-9

Exercise 7-10

Requirement 1 USD

Book value of stock 32,000

Plus gain on sale of stock 12,000

= Note receivable 44,000

Interest reported for the year 4,400

= 10% rate

Divided by value of note 44,000

Requirement 2

To record sale of stock in exchange for note receivable.

To accrue interest on note receivable for twelve months.

? The McGraw-Hill Companies, Inc., 2007

7-10 Intermediate Accounting, 4/e

Exercise 7-11

Requirement 1

Requirement 2

2006 income before income taxes would be understated by 1,800

2007 income before income taxes would be overstated by 1.800.

? The McGraw-Hill Companies, Inc., 2007 Solutions Manual, Vol.1, Chapter 7 7-11

Exercise 7-12

Requirement 1

Requirement 2

3,600 interest for 9 months

÷ 56,400 sales price

= 6.38% rate for 9 months

x 12/9to annualize the rate

_______

= 8.51% effective interest rate

? The McGraw-Hill Companies, Inc., 2007

7-12 Intermediate Accounting, 4/e

Exercise 7-13

Exercise 7-14

1. a

2. a

3. a

4. a

? The McGraw-Hill Companies, Inc., 2007 Solutions Manual, Vol.1, Chapter 7 7-13

Exercise 7-15

Step 1: Accrue interest earned.

Step 2: Add interest to maturity to calculate maturity value.

Step 3: Deduct discount to calculate cash proceeds.

Step 4: To record a loss for the difference between the cash proceeds and the

note’s book value.

Exercise 7-16

? The McGraw-Hill Companies, Inc., 2007

7-14 Intermediate Accounting, 4/e

Exercise 7-17

Exercise 7-18

List A List B

c 1. Internal control a. Restriction on cash.

j 2. Trade discount b. Cash discount not taken is sales revenue.

g 3. Cash equivalents c. Includes separation of duties.

h 4. Allowance for uncollectibles d. Bad debt expense a % of credit sales.

i 5. Cash discount e. Recognizes bad debts as they occur.

l 6. Balance sheet approach f. Sale of receivables to a financial institution.

d 7. Incom

e statement approach g. Include highly liquid investments.

k 8. Net method h. Estimate of bad debts.

a 9. Compensating balance i. Reduction in amount paid by credit customer.

m 10. Discounting j. Reduction below list price.

b 11. Gross method k. Cash discount not taken is interest revenue.

e 12. Direct write-of

f method l. Bad debt expense determined by estimatin

g realizable

value.

f 13. Factorin

g m. Sale of note receivable to a financial institution. Exercise 7-19

1. d

2. c

? The McGraw-Hill Companies, Inc., 2007 Solutions Manual, Vol.1, Chapter 7 7-15

Exercise 7-20

Second quarter:

Receivables turnover = 5,398 = 3.15

1,714

Average collection = 91 = 29 days

period 3.15

Third quarter:

Receivables turnover = 5,620 = 3.14

1,790

Average collection = 91 = 29 days

period 3.14

? The McGraw-Hill Companies, Inc., 2007

7-16 Intermediate Accounting, 4/e

Exercise 7-21

Requirement 1

Step 1: To accrue interest earned for two months on note receivable

Step 2: Add interest to maturity to calculate maturity value.

Step 3: Deduct discount to calculate cash proceeds.

? The McGraw-Hill Companies, Inc., 2007 Solutions Manual, Vol.1, Chapter 7 7-17

Exercise 7-21 (continued)

Step 4: To record a loss for the difference between the cash proceeds and the

note’s book value.

? The McGraw-Hill Companies, Inc., 2007

7-18 Intermediate Accounting, 4/e

Exercise 7-21 (concluded)

Requirement 2

To accrue interest earned on note receivable.

? The McGraw-Hill Companies, Inc., 2007 Solutions Manual, Vol.1, Chapter 7 7-19

Exercise 7-22

1.c.

2.d.

3.c.

Exercise 7-23

Average collection period = 365 ÷ Accounts receivable turnover = 50 days Accounts receivable turnover = 365 ÷ 50 = 7.3

Average accounts receivable = ($800,000 + 600,000) ÷ 2 = $700,000

Accounts receivable turnover = Net sales ÷ Average accounts receivable

7.3 = Net sales ÷ $700,000

Net sales = 7.3 x $700,000 =$5,110,000

? The McGraw-Hill Companies, Inc., 2007

7-20 Intermediate Accounting, 4/e