BFA103_13_lectureillustrationSolutions

REVISION QUESTIONS – WEEK 13

Question 1

Big Rock Ltd

(a) Accounting Rate of Return

Project A

Yr 1 Yr 2 Yr 3 Yr 4 Yr 5 Cash Revenues 300 000 240 000 180 000 120 000 100 000 Cash Expenses (100 000) (80 000) (60 000) (40 000) (10 000) Depreciation (80 000) (80 000) (80 000) (80 000) (80 000) Net Profit 120 000 80 000 40 000 0 10 000

Average net profit = (120 000 + 80 000 + 40 000 + 0 + 10 000)/5 = $50 000

Average net book value = (440 000 + 40 000)/2 = $240 000

so, ARR = 50 000/240 000 x 100 = 20.8%

Project B

Cash revenues each year 160 000

Cash expenses each year (100 000)

Depreciation each year (40 000)

Average net profit $20 000

Average net book value = (200 000 + 0)/2 = $100 000

so, ARR = 20 000/100 000 x 100 = 20%

(b) Payback Period

Project

A

000

440

outlay

Initial

Accumulated net cash inflows:

year

000

200

after

first

after second year 200 000 + 160 000 = 360 000

after third year 200 000 + 160 000 + 120 000 = 480 000

Only $80 000 (out of the $120 000 to be received in 3rd year) is needed to reach payback of $440 000

So, payback = 2 years plus 80 000/120 000 x 12 months

= 2 years 8 months

Project B:

Cash surplus each year is $60 000 so to bring $200 000 back into the business it will take (200 000/60 000) years, that is 3 and 1/3 years or 3 years 4 months to reach payback.

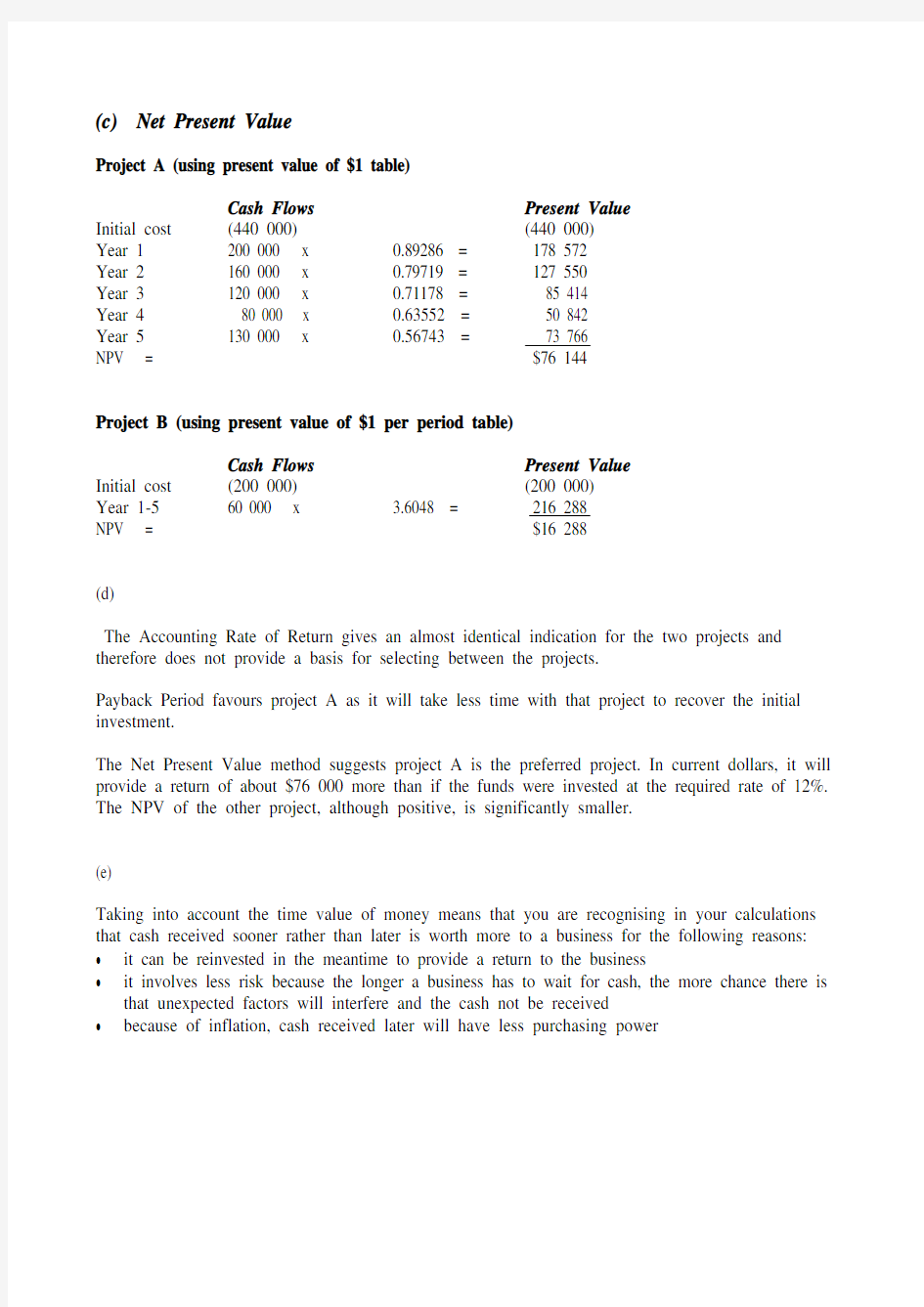

(c) Net Present Value

Project A (using present value of $1 table)

Cash Flows Present Value

Initial cost (440 000) (440 000)

Year 1 200 000 x 0.89286 = 178 572

Year 2 160 000 x 0.79719 = 127 550

Year 3 120 000 x 0.71178 = 85 414

Year 4 80 000 x 0.63552 = 50 842

Year 5 130 000 x 0.56743 = 73 766

NPV = $76 144

Project B (using present value of $1 per period table)

Cash Flows Present Value

Initial cost (200 000) (200 000)

Year 1-5 60 000 x 3.6048 = 216 288

NPV = $16 288

(d)

The Accounting Rate of Return gives an almost identical indication for the two projects and therefore does not provide a basis for selecting between the projects.

Payback Period favours project A as it will take less time with that project to recover the initial investment.

The Net Present Value method suggests project A is the preferred project. In current dollars, it will provide a return of about $76 000 more than if the funds were invested at the required rate of 12%. The NPV of the other project, although positive, is significantly smaller.

(e)

Taking into account the time value of money means that you are recognising in your calculations that cash received sooner rather than later is worth more to a business for the following reasons: ?it can be reinvested in the meantime to provide a return to the business

?it involves less risk because the longer a business has to wait for cash, the more chance there is that unexpected factors will interfere and the cash not be received

?because of inflation, cash received later will have less purchasing power

Question 2

Cash Budget of Bonnie Ltd

for the two months ending 31 August 2010

Total

August

July

Receipts

Cash sales 87 000 75 000 162 000

Credit sales

?June 130 200 130 200

?July 81 200 121 800 203 000

?August 70 000 70 000

Land Sale 120 000 ______ 120 000

Total receipts418 400 266 800 685 200

Payments

Purchases

?June 75 000 75 000

?July 90 000 90 000 180 000

?August 80 000 80 000

Selling expenses 72 500 62 500 135 000

Rent 3 000 3 000

Telephone 2 000 2 000 4 000

Motor Vehicle Purchase 62 000 62 000

Dividends 21 000 21 000

Income tax ______ _14 000 _14 000

Total payments260 500 313 500 574 000

Net cash flow 157 900 (46 700) 111 200

Beginning balance 25 000 182 900 25 000

Closing balance 182 900 136 200 136 200

Question 3

Worksheet of Franny’s Fragrances for the year ended 30 June 2011

No Cash at

bank

Accounts

Receivable

Inventory

Prepay-

ments

Furniture

& Fittings

Acc dep-

Furniture &

Fittings

Accounts

Payable

Accruals

Unearned

revenue

Loan Capital

Profit &

Loss

NOTES 19 500 15 800 40 000 3 000 14 400 (3 300) 6 100 400 1 900 46 000 35 000

1 +45 000 +45 000

2 +36 000 +36 000 Sales

-20

000 -20

000 COGS 3

-2

000 -400 -1

600 Wages 4 -1

900 +1

900 Sales -1

000 -1

000 COGS 5 +8 300 -8 300

6

-1

500 -1

500

7 +13 000 +13 000

8 +15

000 +15

000 Sales -8

000 -8

000 COGS 9 +3 000 +3 000 Sales

-1

100 -1

100 COGS

10 -450 -450 Electricity

11

-6

000 -6

000 Rent

12 -27 500 -27 500

13 -420 -420 Bad

Debts

14 -6 600 +3 300 -3 300 Rent

15 +150 -150 Wages

-3

000 -3

000 Rent

-1 100 -1 100 Dep F&F -11 220 -8 000 -3 220 Interest

11 530 22 080 67 900 3 300 14 400 (4 400) 36 600 150 0 38 000 33 500 6 560

114

810 114

810