Ch02Hull Fund7eTestBank

Test Bank: Chapter 2

Mechanics of Futures and Forward Markets

1.Which of the following is true (circle one)

(a)Both forward and futures contracts are traded on exchanges.

(b)Forward contracts are traded on exchanges, but futures contracts are not.

(c)Futures contracts are traded on exchanges, but forward contracts are not.

(d)Neither futures contracts nor forward contracts are traded on exchanges.

2.Which of the following is not true (circle one)

(a)Futures contracts nearly always last longer than forward contracts

(b)Futures contracts are standardized; forward contracts are not.

(c)Delivery or final cash settlement usually takes place with forward contracts;

the same is not true of futures contracts.

(d)Forward contract usually have one specified delivery date; futures contract

often have a range of delivery dates.

3.In the corn futures contract a number of different types of corn can be delivered

(with price adjustments specified by the exchange) and there are a number of

different delivery locations. Which of the following is true (circle one)

(a)This flexibility tends increase the futures price.

(b)This flexibility tends decrease the futures price.

(c)This flexibility may increase and may decrease the futures price.

(d)This has no effect on the futures price

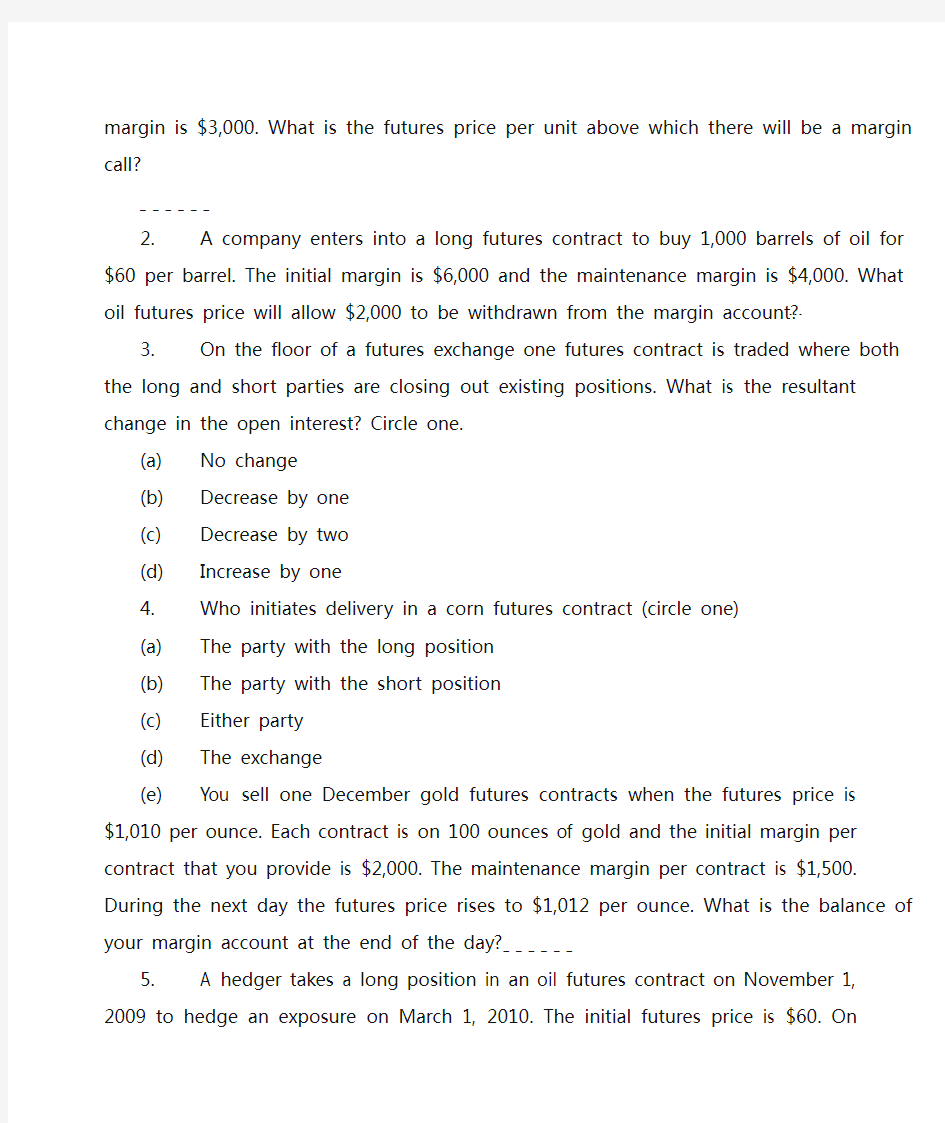

4. A company enters into a short futures contract to sell 50,000 units of a commodity

for 70 cents per unit. The initial margin is $4,000 and the maintenance margin is $3,000. What is the futures price per unit above which there will be a margin call?

_ _ _ _ _ _

5. A company enters into a long futures contract to buy 1,000 barrels of oil for $60

per barrel. The initial margin is $6,000 and the maintenance margin is $4,000.

What oil futures price will allow $2,000 to be withdrawn from the margin account?

…

6.On the floor of a futures exchange one futures contract is traded where both the

long and short parties are closing out existing positions. What is the resultant

change in the open interest? Circle one.

(a)No change

(b)Decrease by one

(c)Decrease by two

(d)Increase by one

7.Who initiates delivery in a corn futures contract (circle one)

(a)The party with the long position

(b)The party with the short position

(c)Either party

(d)The exchange

8.You sell one December gold futures contracts when the futures price is $1,010 per

ounce. Each contract is on 100 ounces of gold and the initial margin per contract that you provide is $2,000. The maintenance margin per contract is $1,500.

During the next day the futures price rises to $1,012 per ounce. What is the

balance of your margin account at the end of the day? _ _ _ _ _ _

9. A hedger takes a long position in an oil futures contract on November 1, 2009 to

hedge an exposure on March 1, 2010. The initial futures price is $60. On

December 31, 1999 the futures price is $61. On March 1, 2010 it is $64. The

contract is closed out on March 1, 2010. What gain is recognized in the

accounting year January 1 to December 31, 2010? Each contract is on 1000

barrels of oil. _ _ _ _ _ _

10.What is your answer to question 9 if the trader is a speculator rather than a hedger?

_ _ _ _ _ _